Inventory Valuation

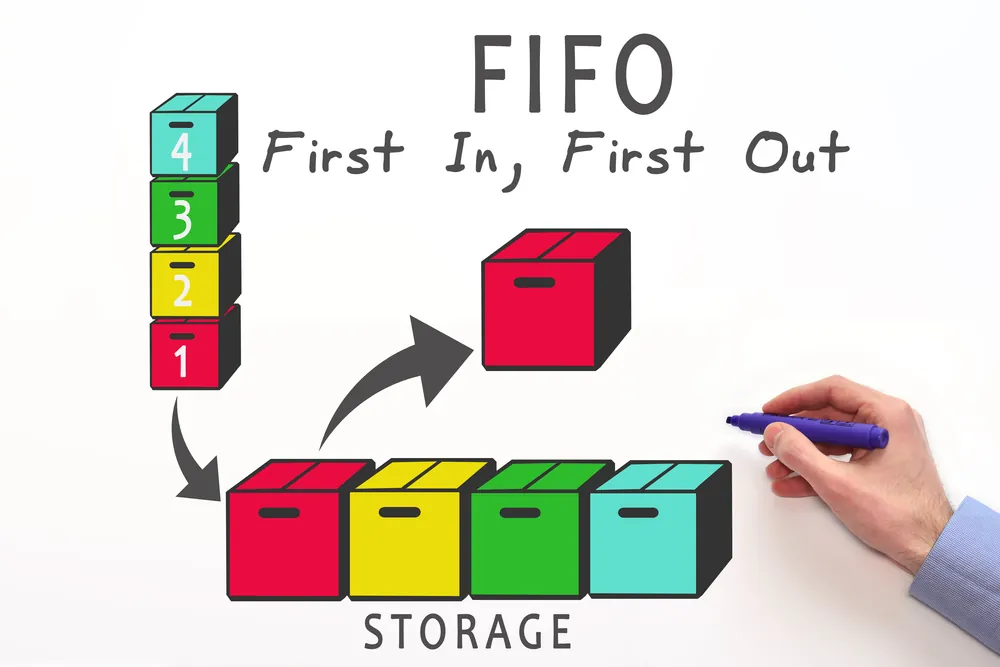

The FIFO (First-In, First-Out) method is primarily used for inventory valuation, significantly impacting a company’s financial statements.

Explanation:

– Oldest Inventory Costs: Under FIFO, the costs associated with the oldest inventory items are the first expensed. This means that the cost of goods sold (COGS) reflects the price of the earliest purchased or produced items.

– Remaining Inventory: The remaining inventory is valued at the most recent costs. This approach tends to align the ending inventory values more closely with current market prices, accurately reflecting the company’s asset value.

Example:

Imagine a bakery that bakes fresh bread daily. On Monday, it bakes 100 loaves at $1 each. Due to increased ingredient prices on Tuesday, it bakes another 100 loaves at $1.20 each. By the end of the week, if the bakery sold 150 loaves, the COGS under FIFO would include 100 loaves at $1 and 50 loaves at $1.20. The remaining inventory of 50 loaves would be valued at $1.20 each, reflecting the most recent cost.

Stock Rotation

The FIFO method ensures efficient stock rotation, critical in industries dealing with perishable goods or items with expiration dates.

Explanation:

– Oldest Items First: By prioritizing the use or sale of the oldest inventory first, FIFO helps prevent the spoilage or obsolescence of products. This is particularly important in food and beverages, pharmaceuticals, and electronics sectors, where products can quickly become outdated or unsafe.

– Minimized Waste: Effective stock rotation reduces environmentally and economically beneficial waste. Companies can maintain better quality control and customer satisfaction by ensuring that the oldest stock, which may be closer to its expiration date, is used or sold first.

Example:

FIFO ensures that older dairy products are sold in a grocery store before fresher deliveries. This not only prevents the older products from expiring on the shelves and being wasted but also maintains the high quality of the products, thereby reducing loss due to spoilage and ensuring customer satisfaction.

Financial Reporting

The FIFO method has significant implications for financial reporting, especially during fluctuating prices.

Explanation:

– Inflation Impact: During inflationary periods, the costs of goods tend to rise. Since FIFO uses the oldest (and typically lower) costs for COGS, the reported profits are higher because the revenue is matched against lower costs. This can make a company appear more profitable in the short term.

– Deflation Impact: Conversely, during deflationary periods when prices fall, FIFO can result in higher COGS and lower reported profits; as older, higher costs are matched against current revenues.

– Balance Sheet Accuracy: FIFO provides a more accurate value of the ending inventory on the balance sheet, reflecting the most recent purchase prices. This can be important for financial analysis and investor relations.

Example:

A retail clothing store that purchases inventory at varying prices yearly will report different profits under FIFO during rising prices. If early in the year, the store buys shirts at $20 each, and later in the year, the cost increases to $25 each, selling shirts later in the year will result in higher reported profits since the COGS will be based on the earlier, cheaper purchases.

Tax Implications

The FIFO method affects a company’s tax liabilities, and impacts reported profits.

Explanation:

– Higher Taxes in Inflation: FIFO leads to higher taxable income because it results in higher reported profits in an inflationary environment. Companies may pay more taxes under FIFO than other inventory valuation methods like LIFO (Last-In, First-Out), which first uses the most recent (higher) costs.

– Strategic Planning: Companies must consider the tax implications when choosing an inventory valuation method. While FIFO can enhance financial appearance, it can also lead to a higher tax burden. Strategic tax planning may involve weighing lower taxes’ benefits versus higher reported profits’ advantages.

Example:

A technology company that experiences significant cost increases in components throughout the year will have higher taxable income under FIFO. If components purchased early in the year at $50 each are used to calculate COGS while the end-of-year purchase price is $70, the company will report higher profits and, subsequently, higher taxes.

Advantages of FIFO

FIFO offers several advantages, making it a popular choice for inventory management and financial reporting.

Explanation:

– Simplicity: FIFO is straightforward to understand and implement. It aligns well with the natural flow of goods, especially in industries where products are sold in the order they are received.

– Realistic Flow: FIFO reflects the physical flow of goods in many businesses, especially those dealing with perishable items. This alignment simplifies inventory tracking and management.

– Accurate Reporting: By valuing ending inventory at the most recent costs, FIFO provides a more accurate representation of the company’s current inventory value on the balance sheet. This accuracy is crucial for financial analysis, loan applications, and investor relations.

Example:

A furniture store that receives regular shipments of sofas can quickly implement FIFO. The oldest stock is sold first, ensuring that inventory management is simple and aligns with the actual flow of goods. The financial statements will accurately reflect the current value of the remaining inventory.

Disadvantages of FIFO

While FIFO has many benefits, it also has some drawbacks that companies must consider.

Explanation:

– Higher Taxes: As mentioned earlier, FIFO can lead to higher taxable income during inflationary periods. This can be a disadvantage for companies looking to minimize their tax liabilities.

– Profit Fluctuations: FIFO can cause significant fluctuations in reported profits if there are substantial changes in inventory costs. These fluctuations can complicate financial planning and analysis.

– Inventory Costing Issues: In industries where inventory costs fluctuate widely, FIFO might not always provide the most accurate picture of COGS, potentially misleading management decisions.

Example:

A company in the electronics industry might face rapid changes in component prices. Under FIFO, if the company buys components at $100 each early in the year and the price drops to $70 later, selling products made with earlier, more expensive components can result in lower profits. Conversely, reported profits and taxes increase if prices rise, adding complexity to financial planning.

Comprehensive Example of FIFO Implementation

Scenario:

Consider a tech company, TechGadgets Inc., which produces and sells various electronic devices. Due to market fluctuations, the company purchases components at varying prices throughout the year.

- January: Purchases 500 units at $50 each.

- April: Purchases 300 units at $55 each.

- July: Purchases 200 units at $60 each.

- October: Purchases 100 units at $65 each.

By the end of the year, TechGadgets Inc. sells 800 units.

FIFO Calculation:

- First 500 units: $50 each (January purchase) = $25,000

- Next 300 units: $55 each (April purchase) = $16,500

Total COGS for 800 units = $41,500

The remaining inventory would be:

- 100 units at $60 each = $6,000

- 100 units at $65 each = $6,500

Total ending inventory value = $12,500

Financial Reporting:

The company’s income statement will show a COGS of $41,500. Based on the most recent purchase prices, the balance sheet will reflect an ending inventory valued at $12,500.

The FIFO (First-In, First-Out) method is critical for inventory valuation and financial reporting. By ensuring that the oldest inventory costs are used first, FIFO aligns inventory management with the actual flow of goods, especially in industries dealing with perishable items. It offers the advantage of reflecting current market values in the ending inventory and simplifies implementation. However, FIFO can also lead to higher taxable income in inflationary periods and cause fluctuations in reported profits. Companies must weigh these factors against their specific needs and financial goals to determine the best approach for their inventory management and reporting practices.