FedEx’s Strategic Shifts: Enhancing Shareholder Value & Fleet Optimization

FedEx’s 2025 Plan

FedEx Corporation is undergoing significant strategic changes to enhance shareholder value and streamline its operations. This blog post explores these initiatives, focusing on the potential spin-off of FedEx Freight and the optimization of its air fleet. We’ll discuss the implications of these moves and what they mean for FedEx’s future.

FedEx Freight: A Potential Spin-Off

FedEx is conducting a strategic analysis of its less-than-truckload (LTL) segment, FedEx Freight, to assess its value within its portfolio. This assessment suggests that FedEx Freight might be sold or spun off, allowing FedEx to concentrate more on its parcel and logistics business.

CEO and President Raj Subramaniam emphasized this during a recent call with analysts, highlighting the importance of this review in their long-term value-creation plans. FedEx Freight has been the company’s best-performing segment, boasting operating margins of 20% over the past two years. Its efficiency is second only to Old Dominion Freight Line (ODFL), with an impressive operating ratio of 80%.

What The Experts Are Saying

Industry experts like Satish Jindel, founder and president of ShipMatrix Inc., believe that spinning off FedEx Freight as an independent company would maximize shareholder value. Jindal argues that issuing shares to current investors would yield greater returns than a sale, especially since FedEx Freight is too large and expensive for other carriers to buy. He previously urged FedEx to make this move, citing the segment’s significant market capitalization and potential for higher valuation as a standalone entity.

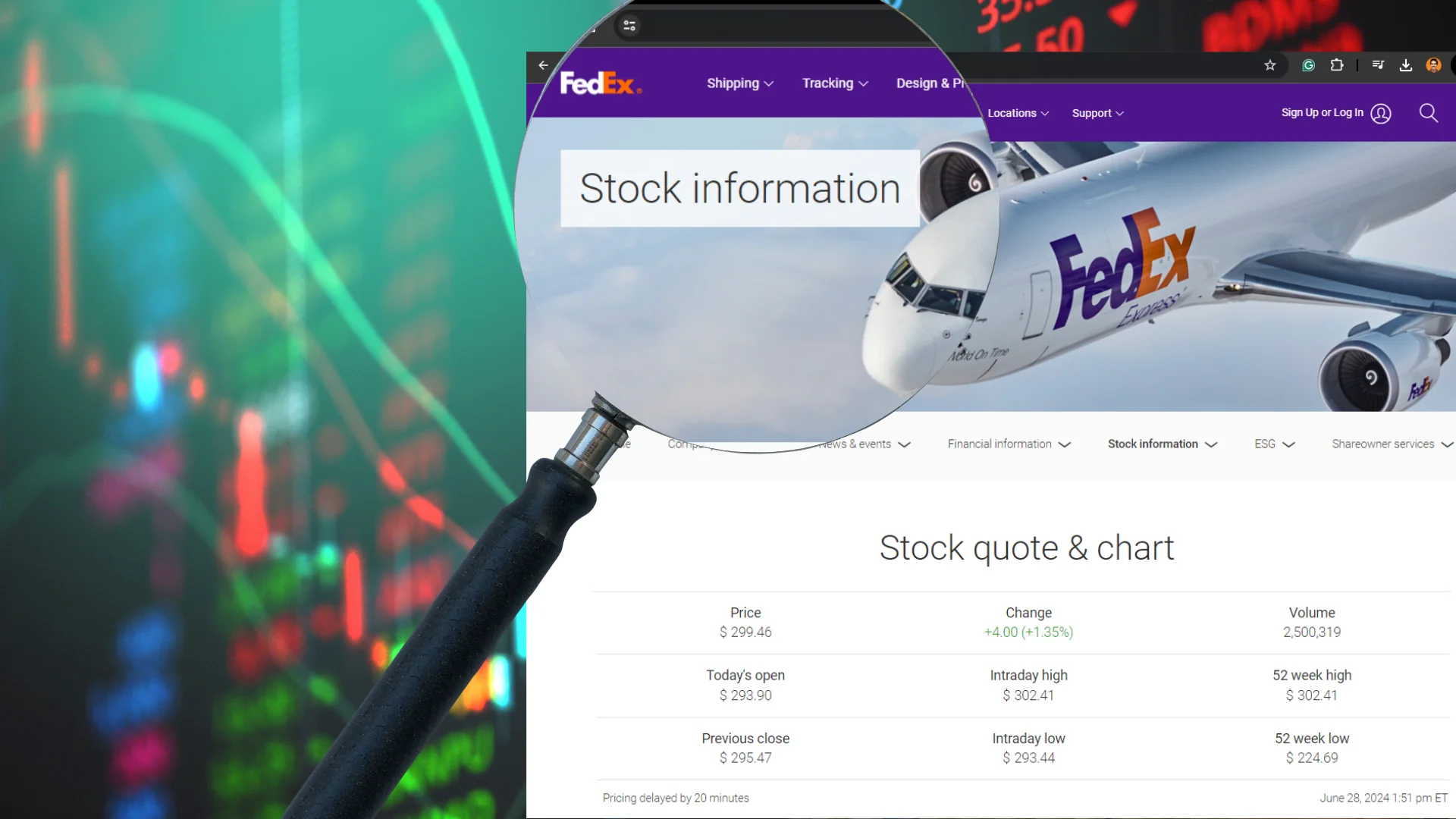

Analysts also support this view, noting that the division has become the most profitable part of FedEx’s portfolio. For now, market enthusiasm around this potential spin-off has substantially increased FedEx’s stock price.

Fleet Optimization and Cost Savings

In parallel, FedEx is optimizing its air fleet to better align with current demand. The company has permanently retired 22 Boeing 757-200 freighter aircraft, citing the need to improve fuel efficiency and reduce costs. This move resulted in a $157 million impairment charge, adding to last year’s write-off for retiring 18 MD-11 freighters.

FedEx’s fleet reduction aligns with its broader strategy to streamline operations in response to slower parcel demand. The company also plans to end its role as the primary air cargo provider for the U.S. Postal Service and transition this business to UPS. This shift is expected to reduce operating income in the short term but will ultimately lead to significant cost savings.

Despite these changes, FedEx continues to invest in its fleet, with plans to add two Boeing 777 freighters and 14 B767-300s in the coming years. Maintaining an efficient and capable fleet to support its logistics operations remains the focus.

Financial Performance, Shareholders and Future Outlook

FedEx’s recent financial performance underscores the success of its cost-saving initiatives. The company reported a 5.6% increase in adjusted operating income and a 1% revenue bump in the fourth quarter. These results reflect FedEx’s ability to contain costs amid challenging market conditions, achieving structural savings of $1.8 billion last year with a target of $2.2 billion in fiscal year 2025.

FedEx anticipates continued momentum, driven by its transformation program and efforts to create a more flexible, efficient, and intelligent network. The company’s fiscal year 2025 guidance calls for modest revenue growth and a significant adjusted earnings per share increase.

FedEx’s strategic initiatives, including the potential spin-off of FedEx Freight and the optimization of its air fleet, demonstrate the company’s commitment to enhancing shareholder value and adapting to market conditions. These moves position FedEx for future growth and ensure it remains competitive in logistics. As the company continues executing its transformation program, stakeholders expect further efficiency, profitability, and overall performance improvements.