AAA Cooper Claims

Efficiently file and manage your AAA Cooper claims with ease. Our streamlined process ensures quick resolution for lost or damaged shipments, providing peace of mind and reliable support. Trust AAA Cooper for transparent handling of your claims, securing your satisfaction, and safeguarding your shipping investments.

Need to file AAA Cooper Claims (ACT)?

We’ve pulled together a few tips for filing a claim with the carrier.

Dealing with lost or damaged shipments can be a real headache, but with AAA Cooper, it’s much simpler than you might think. This streamlined process makes filing and managing your AAA Cooper claims pretty straightforward. So, if something goes wrong with your shipment, you don’t have to worry about a long, complicated process to get things sorted out. AAA Cooper works fast to resolve any issues, whether it’s something that got lost or arrived damaged. This quick resolution is a big deal because it means you can relax knowing that your shipment problems will be handled swiftly, giving you peace of mind and allowing you to focus on other essential things.

What’s excellent about AAA Cooper is their transparency when handling your AAA Cooper Claims. They keep you in the loop, so you always know what’s happening with your claim and how they’re working to resolve it. This transparency builds trust, showing that AAA Cooper is a reliable partner for your shipping needs. They’re all about ensuring you’re satisfied with how your claim is handled, which means a lot when dealing with the stress of a lost or damaged shipment. By choosing AAA Cooper, you’re not just shipping your items but also protecting your shipping investments with a company that cares about keeping your goods safe and your mind at ease.

Award-Winning Service, Trusted by Shippers Everywhere!

- 2021, 2017 & 2016 Food Logistics’ Top Green Providers

- 2021 & 2018 Supply & Demand Chain Executives’ Pros to Know: Matthew Brosious

- 2020 & 2019 Top Food Logistics’ 3PL & Cold Storage Provider Award

- 2020 & 2019 Business Observer’s Top 500 Companies on the Gulf Coast

- 2020 & 2017 SmartWay® Transport Partner

- 2020 & 2017 Food Logistics’ Champions: Rock Stars of the Supply Chain

- 2020 Best of Palm Harbor Awards for Local Businesses

- 2017 Green Supply Chain Award from Supply & Demand Chain Executive

- 2017 Tampa Bay Business Journal Heroes at Work

- 2016, 2015, & 2012 Food Logistics Top 100 Software and Technology Providers

- 2013 Tampa Bay Business 100 by Tampa Bay Business Journal

- 2013 Top 100 Great Supply Chain Partners by SupplyChainBrain

- 2012 TIA Samaritan Award Honorable Mention

- 2012, 2011 & 2010 TBBJ Fast 50 Recipient

- 2013, 2011, & 2010 Diversity Business Top Businesses

AAA Cooper Claims

When shipping stuff with AAA Cooper, sometimes things don’t go as planned, and you might need to file a claim. Depending on what went wrong with your shipment, you might encounter a couple of different types of AAA Cooper claims. Let’s break them down so you know what to expect and how to handle them.

The first type is a **AAA Cooper damage claim**. This is when the items you shipped arrive but are not in the same condition as when they started their journey. Maybe a box got crushed, or something inside broke. If this happens, you’ll need to provide details about the shipment and what was damaged, including pictures if you can. It’s essential to check your items as soon as they arrive so you can report any damage right away.

The second type is a **AAA Cooper loss claim**. This one’s pretty straightforward—it’s when your shipment never arrives at its destination. It could be that it got lost somewhere along the way or was never loaded onto the truck. For a loss claim, you’ll need to prove that the items were picked up but didn’t arrive where they should go. This might involve showing a receipt or order confirmation as proof that the shipment was supposed to happen.

Filing AAA Cooper Claims through FreightCenter makes the process easier in both cases. You’ll need to gather all the relevant info about your shipment, like tracking numbers and details about what went wrong, and then fill out the proper forms on the FreightCenter website. They’ll help guide you through the process and work with AAA Cooper to resolve your claim, whether it’s for damaged or lost items. It’s all about ensuring you’re taken care of and that any issues with your shipment are sorted out as smoothly as possible.

How to file AAA Cooper Claims

Filing a lost or damaged shipment claim can seem daunting, but dealing with AAA Cooper through FreightCenter is much more straightforward than expected. Here’s how it works: if something goes awry with your shipment, the first step is to head to the FreightCenter website. This is where you’ll find all the guidance and forms needed to kick off your claim. It’s super important to gather all the details about your shipment beforehand, such as the tracking number and a clear problem description. If your items were damaged, having photos ready can help illustrate the extent of the damage. This preparation makes the process smoother and helps AAA Cooper get a clear picture of what happened.

Once you’ve got all your information, filling out the claim form on FreightCenter’s website is your next move. This form is your official way of letting AAA Cooper know there’s been an issue with your shipment. FreightCenter makes this part easy by guiding you through each step and providing the form on their site. After you submit it, FreightCenter will forward your AAA Cooper claims direct to them. This means you don’t have to worry about dealing directly with the carrier, which can save you a lot of time and hassle. FreightCenter acts as your advocate, ensuring your claim gets the attention it needs from AAA Cooper.

After submitting your claim, patience is vital, but rest assured that FreightCenter and AAA Cooper work together to resolve AAA Cooper Claims as quickly as possible. You can check in on the status of your claim directly through FreightCenter, which will also keep you updated on any progress or additional info that might be needed. This collaborative effort between FreightCenter and AAA Cooper means you have a dedicated team working behind the scenes to address your claim efficiently. They aim to ensure you’re compensated for lost or damaged goods, helping minimize the impact on your business or personal plans. With their support, you can feel confident that your claim is in good hands, letting you focus on what matters most to you.

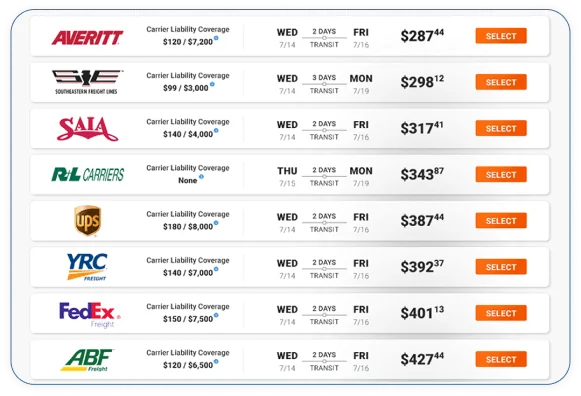

Compare AAA Cooper freight to 50+ carriers

What to do when freight damage is found

Thoroughly inspect the integrity of the external packaging

If external packaging, shrink wrap etc. is not intact, record any damages on the Bill of Lading (BOL) or Proof of Delivery Receipt (POD).

Take photographs of any external packaging damage and product damage.

Contact AAA Cooper Transportation immediately to report damages (not your third-party logistics service provider).

Don’t throw anything away. If AAA Cooper Transportation (ACT) inspects the product, they will use this to determine if the damage to the product is consistent with damage to containers.

Note: For concealed damage, most carrier have a 5-day deadline from the delivery date to file any damage claims. If you find damages after the delivery of your product, follow the same protocol above within those 5 days.

Who do I contact about freight claims?

I Shipped Using

I Purchased Freight Insurance

What to Do

- Contact FreightCenter at 800.716.7608

- Contact AAA Cooper Transportation (ACT) immediately to report damages

- Contact FreightCenter at 800.716.7608

- Contact AAA Cooper Transportation (ACT) immediately to report damages

- Contact FreightCenter at 800.716.7608

- Contact AAA Cooper Transportation (ACT) immediately to report damages

I Shipped Using

I Purchased Freight Insurance

What to Do

- Contact FreightCenter at 800.716.7608

I Shipped Using

I Purchased Freight Insurance

What to Do

- Contact AAA Cooper Transportation (ACT) immediately to report damages

- Contact FreightCenter at 800.716.7608

I Shipped Using

I Purchased Freight Insurance

What to Do

- Contact AAA Cooper Transportation (ACT) immediately to report damages

- Contact FreightCenter at 800.716.7608

I Shipped Using

I Purchased Freight Insurance

What to Do

- Contact AAA Cooper Transportation (ACT) immediately to report damages

Filing a freight claim with AAA Cooper Transportation (ACT)

Double check that AAA Cooper Transportation (ACT) handled the damaged freight. You can find the carrier on your BOL paperwork.

Click the claim form link for the carrier that handled the damaged freight

Important

To make a valid liability claim, AAA Cooper Transportation (ACT) must be at fault for the damaged or lost freight.

If damages occur from inadequate packaging, loading errors, or weather-related instances, AAA Cooper Transportation (ACT) is not responsible or at fault for the damage.

AAA Cooper Transportation Claims Department Contacts

- AAA Cooper Claims Form:

- AAA Cooper Transportation Email:

- Phone:

- Fax:

What Happens Next?

The following is general carrier policies. AAA Cooper Transportation (ACT) may have policies that differ somewhat.

After a claim is submitted with the proper documentation, the carrier has 30 business days to acknowledge the claim

Carrier will assign a claim number to the file

Often claims take a while to investigate. Legally, the carrier has 120 days to respond with approval or denial of claim

After the 120 business days, the carrier will continue to keep you informed at 60 business day intervals until your claim is settled